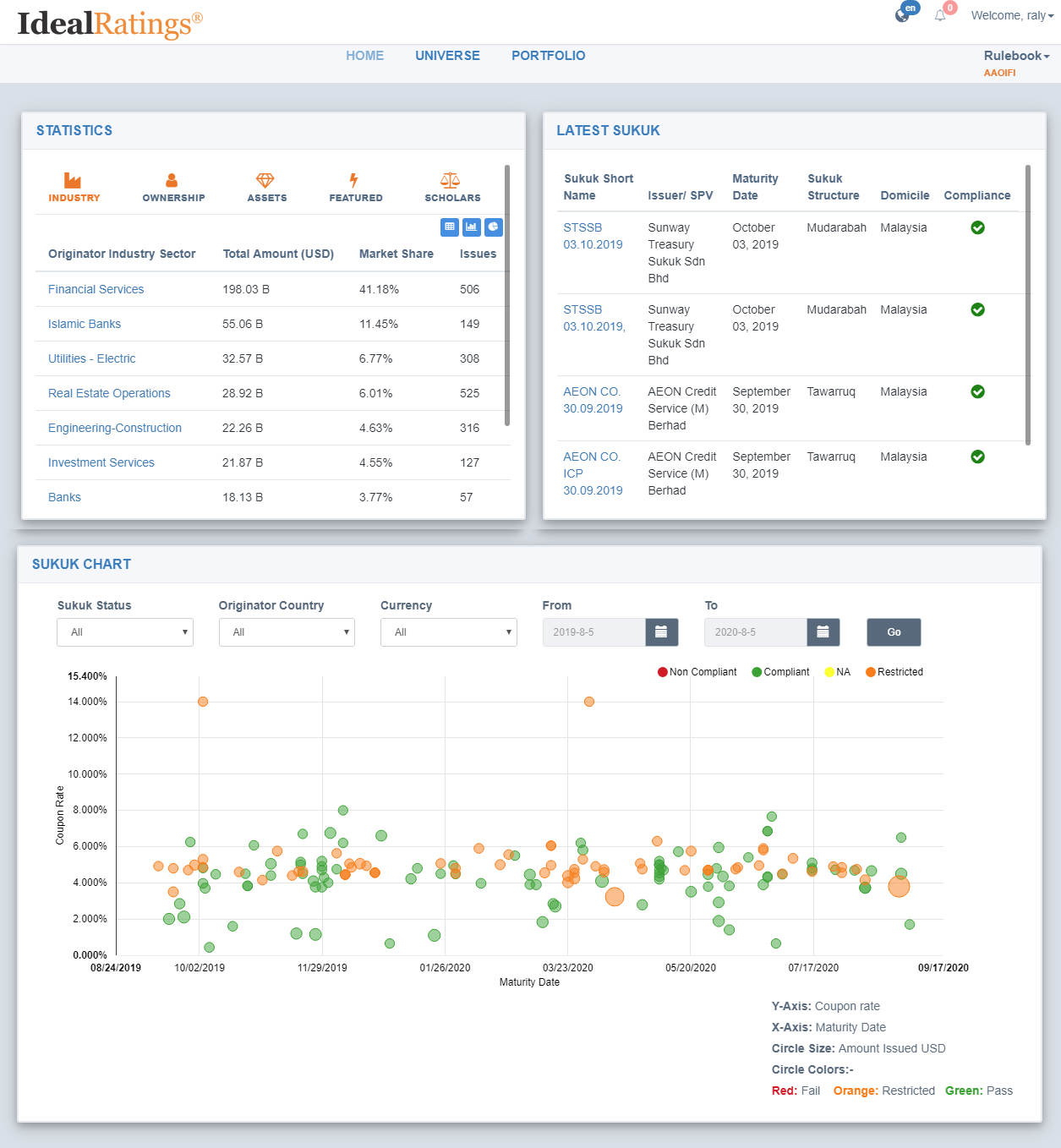

Sukuk Screening

The first ever and only Sukuk Shariah screening solution with an engine that allows Shariah auditors, asset managers and treasuries to import their custom institutional Shariah guidelines and screen the global universe of sukuk against such mandate and against Market standards such as AAOIFI and SC. The solution has been designed to constitute all sukuk standards from the different Shariah schools and allows users to fully configure the compliance engine to their accepted standards. The solution has been reviewed, audited and approved by prominent Scholars and boards across the globe. The solution is also ideal for fixed income traders and treasuries with comprehensive coverage of all financial, credit and legal details about every issuance. Along with IdealRatings Sukuk analysts’ propriety bi-lingual structure diagram that illustrates the asset and cash flow of complex structures in few lines. Altogether, IdealRatings Sukuk Screening solution is outstandingly the perfect solution for sukuk investing, resolving the Shariah risk, while adhering to the financial, legal and credit needs in a fixed income investment.

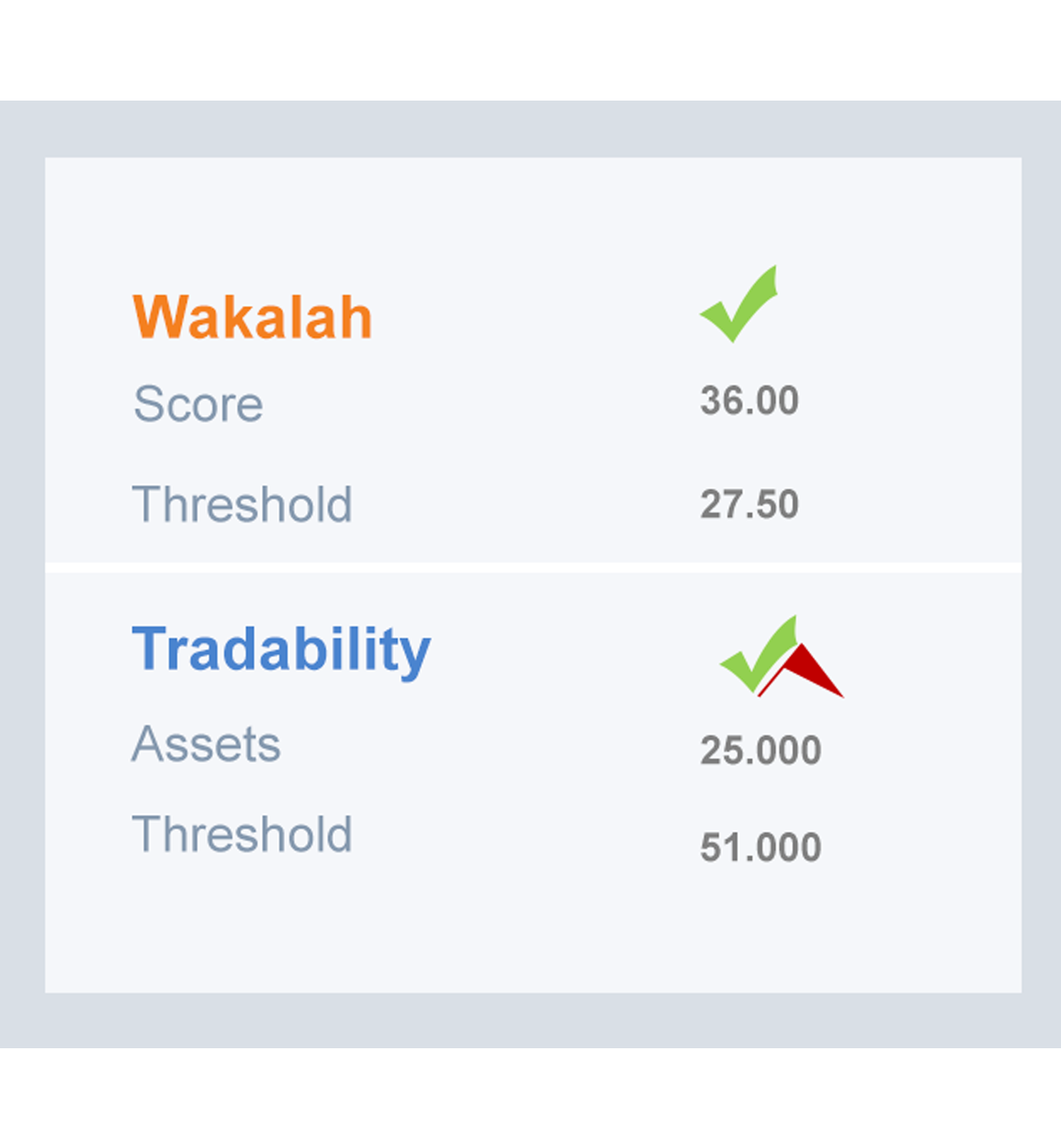

Sukuk Tradability

Out of its extensive Sukuk screening practice, IdealRatings has developed a Sukuk tradability indicator on the Sukuk solution, whereby, Compliant Sukuk are analyzed further against a “Tradability Threshold”. A custom indicator is developed to custom-configure the tradability of Sukuk as per the mandate sought after by each user. Where Shariah views on trading debt, range from absolute permission to absolute prohibition. The indicator allows every user to set the “Required Assets Threshold” above which the Sukuk is deemed “Permissibly Tradable”